When opening a company in Serbia, one must align with the requirements of the tax regime in this state, including for VAT for which a firm must be registered before it begins the operations. Our company formation agents in Serbia can offer assistance and complete information for foreigners interested in the Serbian VAT for a foreign company. Also, the rules for business in 2024 can be entirely explained by one of our specialists.

| Quick Facts | |

|---|---|

| We offer VAT registration services |

Yes |

|

Standard rate |

20% |

|

Lower rates |

10% |

| Who needs VAT registration |

Companies with activities in Serbia |

| Time frame for registration |

Around 30 days |

| VAT for real estate transactions |

– 10% on purchase of residential properties, – 20% on garages and commercial properties |

| Exemptions available |

No VAT for: – trading shares and different securities, – insurance, – apartment lease |

| Period for filing | Monthly or quarterly |

| VAT returns support | Yes |

| VAT refund |

To: – foreign taxpayers, – humanitarian organizations, – religious communities |

| Local tax agent required | Recommended for non-Serbian companies |

| Who collects the VAT |

Serbian Tax Administration |

| Documents for VAT registration |

– Articles of Association, – Certificate of Registration, – other standard forms |

| VAT number format | 9 digits |

| VAT de-registration situations |

In case the company ceases the activities or relocates |

Table of Contents

Serbian VAT for a foreign company

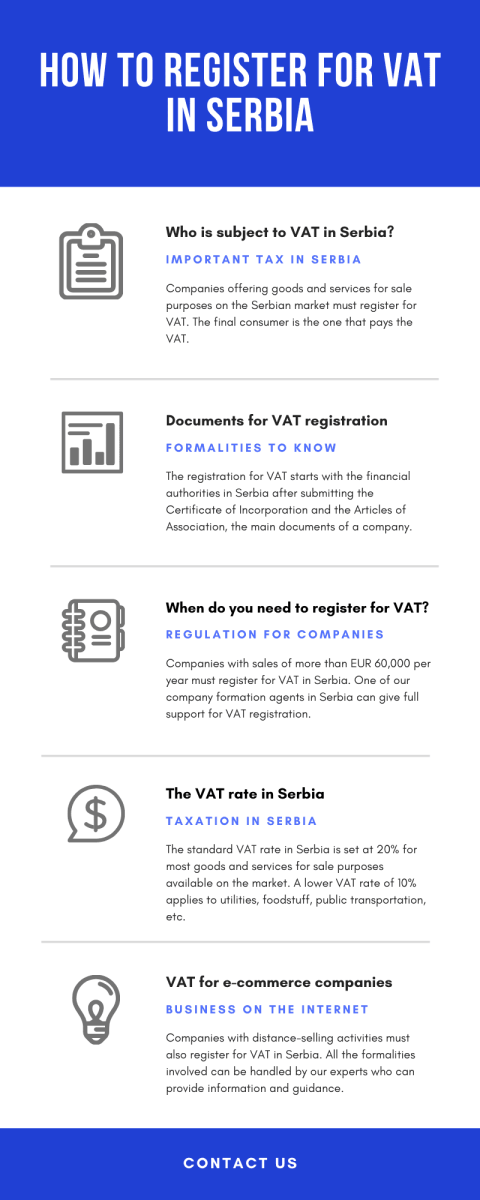

Non-Serbian entities must respect the tax rules imposed in this country. Serbian VAT for a foreign company has the same rules as imposed for the local firms, and below we present a few formalities:

- Foreign companies are not obliged to appoint a fiscal representative, however, it is recommended to have one for a smooth and rapid registration process.

- The VAT registration in Serbia is done with the Serbian tax authorities.

- The company’s documents such as the Certificate of Incorporation and Certificate of Good Standing are required for VAT registration in Serbia.

- Late penalties can be imposed for companies that do not register for VAT in Serbia.

- Those interested in Serbian VAT registration for a foreign company can solicit the support of our local company formation agents in Serbia who can properly manage the formalities.

Serbia can be one of the optimal business destinations for the development of businesses with potential. If you are among those who want to invest in this country, we recommend the services offered by one of our accountants in Serbia. Among the necessary procedures for a company, we mention payroll, annual financial statements, tax advice, and compliance.

The PR1 declaration is needed for VAT registration in Serbia, the process can take around 2 weeks in principle, depending on the procedures and a representative tax is needed especially for foreign entities that deal with supply of goods to Serbia.

VAT registration for a local company in Serbia

Both local and foreign companies in Serbia must comply with the rules for VAT registration in Serbia. As we mentioned above, the company’s documents are needed for registration. Then, the tax authorities will issue the VAT tax code, which certifies that the respective company complies with the legislation regarding the payment of taxes.

The VAT registration for a local company in Serbia is made if the firm supplies goods and services on the territory of Serbia, but also in other locations, and imported goods in Serbia, as long as there are no restrictions in this regard. You have the support of our local agents for VAT registration for a local company in Serbia.

How to check if a company is registered for paying taxes

Those interested in checking a company’s registration for paying taxes, including VAT, can do so by accessing the database of the Serbian Tax Authority. All the data about the company are mentioned here, such as:

- Name and address of the company.

- Number of employees

- VAT ID number.

- Registered bank account.

- Date of company registration in Serbia.

A company is seen as a taxpayer in Serbia only if the VAT ID is issued, alongside a decision in this sense. Such a decision must also comprise details about the tax representative for the respective company which can be one of our local agents in Serbia.

You might want to watch the following video presentation on this topic:

Non-established companies and VAT in Serbia

There is the possibility of VAT registration in Serbia without the company being established in this country. The VAT rate is the same, 20%, and involves companies that are not registered in Serbia for their activities, that do not have a representative office, and that offer digital services for sale in this country. We remind you of the support of our local agents who can provide you with the necessary support to do VAT registration in Serbia without complications.

Information about the VAT imposed in Serbia

From the beginning, we mention the Law on Value Added Tax in Serbia was revised in 2012, but additional modifications were observed each year. In this sense, it is good to know that the standard VAT in Serbia is set at a 20% rate for certain goods and services, but there is also a lower VAT rate of 8% which is applicable to special categories like basic food, medicines, bottled water, computers, public transportation, utilities, newspapers, and magazines.

Having knowledge about the taxes which need to be paid in Serbia will help the entrepreneurs set up their companies in complete agreement with the requirements imposed by the legislation of this country. Company formation in Serbia is an easy process that can be overseen by our Serbian team of company formation specialists.

The Serbian Tax Administration is the institution that issues the approvals for the VAT representation and registration of foreign companies. In many cases, the VAT ID is issued in about 2 weeks or more.

VAT exemptions in Serbia

In Serbia, there are certain categories of goods and services that are not subject to VAT, such as:

- the export of goods;

- international air transport;

- education;

- medical services;

- financial services;

- charity;

- culture and entertainment;

- organizing of gambling and lotteries services.

For more information about the tax exemptions in Serbia, you may address our company incorporation agents in Serbia.

VAT in the real estate sector in Serbia in 2024

The VAT imposed on the first transfer of the right of use of a real estate property in Serbia is set at 8%. As for the new buildings in Serbia, their prices will comprise a VAT of 20%. Besides that, the property tax in Serbia is set at a rate of 0.4% of the market value and it is imposed once per year for companies that own properties in this country. Besides this tax, a transfer fee or 2.5% rate is issued for real estate properties that are at a certain point subject to ownership transfer. It is good to know that there are no stamp duties in Serbia.

The VAT return in Serbia

The VAT recovery for companies offering goods and services in Serbia will have to comply with a few conditions, mostly related to the needed documents, among which, are the confirmation stating that the VAT for imported items has been paid or the invoice with information about the goods that are VAT subject.

There are also cases where the VAT cannot be requested back and this rule is applicable to imported items like vehicles, vessels, motorcycles, car parts, household appliances, etc. Also, the VAT imposed for entertainment services and products cannot be claimed.

If you believe you need support for VAT registration and returns, we suggest you get in touch with one of our company formation specialists in Serbia who can offer in-depth guidance and assistance. You can also ask for help in matters of company formation in Serbia and speed up the registration process. Entrepreneurs in Serbia can easily start a business in Serbia in 2024. You can contact us for more details about VAT registration in Serbia.

As it is known, the VAT is the consumption tax in Serbia, and it is applied to almost everything sold in this country. Even so, one should note that there are particular guidelines for selling digital products, which should be followed in 2024.

Is there a VAT threshold in Serbia?

No, there is no VAT threshold in Serbia and this means that each product or service sale is subject to VAT, depending on the category of goods.

Do I need a local tax representative in Serbia?

No, this is not imposed, however, it is recommended to pay attention to the requirements for VAT registration in Serbia and solicit the support of a fiscal representative, especially if you are a foreign business owner. You can get in touch with one of our consultants who can represent your company if you are a foreign entrepreneur, especially in company registration and tax registration in Serbia, including VAT.

Is there a VAT for digital products and services in Serbia?

Yes, the digital tax policies apply to site hosting services, internet providers, cloud-based software services, streaming music, and audio-visual products like e-books, movies, images, etc. The VAT regime in Serbia might seem complex for digital services and products and will depend on the number of sales.

The content of a VAT invoice

All goods and services are sold with an invoice which needs to have specific content and information. The business name, the invoice date, the VAT number, the customer’s name, the VAT rate imposed, and the final amount are important details comprised by an invoice, regardless of the products or services sold, except the ones where such a tax is not imposed. Companies in Serbia normally use particular software to issue and send invoices to clients and partners.

The status of taxpayers in Serbia comes with a series of financial responsibilities for which an accountant is needed. If you would like to open a company in Serbia and need an accounting firm, you can talk to us and ask for support. Besides company formation in Serbia, you can benefit from the services of an experienced team of accountants. You might find useful the following information about the VAT rate and its applicability to the supply of goods:

- The delivery of products manufactured in accordance with the client’s request.

- All products which are subject to import and export trading.

- The delivery of products or services under a leasing contract involving movable or immovable properties.

- Even the transfer of ownership rights, copyrights, and patents is subject to such a tax.

- The supply of services with compensation enters the VAT category.

We remind you that there is a special VAT tax rate of 10% which is applicable to bakery products, plants, milk and dairy, frozen fruits and vegetables, butchery and fish products, cereals, veterinary medicines, fertilizers, accommodation services, communal waste, maintenance of green areas. 8% rate applies to basic foods.

For specific details about the goods and services subject to VAT, we recommend you talk to one of our specialists. Also, if you are interested in opening a company in Serbia, and you want support, do not hesitate to get in touch with us. We can tell you more about VAT registration in Serbia.

The VAT rule of reciprocity

Under the rule of reciprocity, Serbia can grant a VAT refund for citizens or companies from countries where the same rule applies. For example, Serbia signed a series of VAT reciprocity agreements with countries like Montenegro, Slovenia, Germany, Austria, the Netherlands, Norway, Slovakia, Romania, Turkey, Switzerland, Croatia, Belgium, UK, and Macedonia.

The VAT refund applies to specific means of transportation, car repairs, car rentals, accommodation, and lodging, restaurant services, and related costs of seminars, fairs, and exhibitions. All original invoices, proof of payment, bank account statements, and other specific forms need to be considered for a VAT refund in Serbia. All the information you need in this matter can be offered by one of our company formation agents in Serbia.

Short facts about double tax treaties in Serbia

Serbia signed numerous double taxation agreements with countries worldwide with the intention of providing extra protection to company profits. The avoidance of fiscal evasion is another important aspect related to the provisions of the double taxation arrangements signed by Serbia. Albania, Armenia, Austria, Azerbaijan, Belgium, Bosnia and Herzegovina, Bulgaria, China, Croatia, Canada, Czech Republic, Cyprus Estonia, Denmark, Egypt, Finland, France, Greece, Ghana, Georgia, Hungary, Italy, Iran, India, Kazakhstan, Indonesia, Libya, Kuwait, Luxembourg, Latvia, Lithuania, Macedonia, Malaysia, Morocco, Montenegro, Malta, Norway, North Korea, the Netherlands, Pakistan, Poland, Qatar, Romania, Russia, Slovakia, Slovenia, South Korea, Sweden, Sri Lanka, Switzerland, Spain, Tunisia, Ukraine, Turkey, UK, the UAE, Uganda, Vietnam, and Zimbabwe are among the countries that signed a double taxation treaty with Serbia.

In terms of tax provisions, the exemption is applicable if the company paid the taxes in the country of origin instead of paying the taxes in Serbia where the activities are implemented. There are smaller withholding taxes for interests, royalties, and dividends if mentioned by the double taxation agreement signed with Serbia. it is important to know that a proof of the paid taxes needs to be made to the Serbian authorities if such taxes have been paid in the country of origin. If you would like to know more about the double tax treaties signed by Serbia we invite you to discuss to one of our company formation agents in Serbia who can also tell you more about how to register for VAT in Serbia.

Tax minimization in Serbia – what to consider

The VAT is an important tax in Serbia and one that should be considered when having a business in this country, alongside the corporate tax, dividend tax, and many other fees. The importance of having a tax minimization strategy in the company should be in the attention of both local and foreign investors in Serbia with activities in this country. Tax minimization tools in Serbia should be implemented in companies of any kind in order to avoid overpaying taxes.

For example, paying the bills and credits in advance for a couple of months might be subject to varied tax exemptions or lower fees. A tax plan can include tax deductions for bonuses, gifts, office supplies, subscriptions and many more. Charities in Serbia can be excellent options when it comes to tax minimization methods, and that because foundations are not subject to taxation in this country. A complete tax plan can be provided by one of our consultants in Serbia. In terms of accounting, you should seek complete support from one of our advisors. He/she can tell you more about VAT registration in Serbia.

Other taxes in Serbia

The corporate income tax is set at a 15% rate, one of the lowest among European countries. It is good to know that an exemption of 80% from the corporate tax is applicable in a form of incentive to the royalties of intellectual property owners in Serbia.

VAT is one of the most essential taxes applied for goods and services available for sale in Serbia. However, there are other taxes to take into account if you have a business in Serbia:

- Excise duties – imposed for alcoholic beverages, tobacco products, coffee, and oil products.

- Customs duties – goods imported into Serbia are subject to customs duties. These taxes range from 0% to 57.6%.

- Stamp taxes – not imposed in Serbia.

- Transfer tax – if VAT is not imposed on the transfer of real estate property, the transfer tax enters the discussion. This tax is also imposed for expropriated real estate in Serbia.

- Property tax – an annual tax that is paid by both companies and individuals who own properties in Serbia.

Non-residents in Serbia are subject to a 20% rate capital gains tax. Employers in Serbia must pay attention to the taxes and contributions imposed on gross salary. 10% rate is the personal income tax, and 17.15% is the social contribution tax rate paid by the employer.

Why invest in Serbia

Serbia is open for business in most the attractive sectors, no matter if you are a local or a foreign entrepreneur. Oriented towards investors, Serbia offers a series of advantages, especially when it comes to company registration, a procedure that has been simplified quite much in recent years. The tax regime and the ease of doing business in Serbia, make international investors look for the investment opportunities in this country. The following facts and figures might convince business persons about the positive direction of Serbia:

- around USD 39.833 million was the total FDI stock for Serbia in 2018.

- the FDIs in Serbia increased by EUR 338 million in April 2019 compared to the same period last year;

- 60% is the rate representing the services that sustain the economy in Serbia;

- Around $25 billion representing the amount of FDIs in Serbia has been registered since 2000.

If you are interested in more details about the VAT registration in Serbia in 2024 but also on how companies can be registered in Serbia, please feel free to contact our team of advisors at any time.